The Evolution of Cryptocurrency in 2025

The cryptocurrency market has seen significant growth, volatility, and technological advancements over the past decade. With 2025 on the horizon, investors and enthusiasts are asking a critical question: Will Bitcoin and Ethereum continue to dominate, or will emerging altcoins and blockchain innovations challenge their supremacy?

Bitcoin: The King of Crypto in 2025?

Bitcoin’s Price Predictions

Bitcoin has consistently been the largest cryptocurrency by market capitalization, often referred to as digital gold. Analysts predict that Bitcoin could reach new all-time highs in 2025, with some forecasting prices upwards of $150,000 due to increasing institutional adoption and scarcity.

Factors Supporting Bitcoin’s Dominance

- Institutional Investment: Major financial firms continue to add Bitcoin to their portfolios as a hedge against inflation.

- Scarcity and Halving Cycles: Bitcoin’s 2024 halving event is expected to reduce supply, historically leading to bullish trends.

- Regulatory Clarity: More countries are establishing clear frameworks for Bitcoin, further legitimizing it as an asset class.

Challenges to Bitcoin’s Dominance

- Energy Consumption Issues: Governments may impose stricter regulations on Bitcoin mining due to environmental concerns.

- Slow Transaction Speeds: Layer-2 solutions like the Lightning Network are helping, but Bitcoin still faces scalability challenges.

- Increased Competition: Other cryptocurrencies are offering faster, cheaper, and more energy-efficient alternatives.

Ethereum in 2025: The Smart Contract Giant

Ethereum 2.0 and the Merge’s Impact

Ethereum’s transition to Ethereum 2.0 has brought significant improvements in scalability, security, and energy efficiency. The move to Proof-of-Stake (PoS) has reduced energy consumption by 99%, making Ethereum a more sustainable investment.

Ethereum’s Role in DeFi and Web3

- Decentralized Finance (DeFi): Ethereum remains the backbone of the DeFi ecosystem, supporting lending, staking, and decentralized exchanges.

- NFT Growth: Non-fungible tokens (NFTs) continue to thrive, with Ethereum leading as the primary blockchain for digital art, gaming, and collectibles.

- Enterprise Adoption: More companies are leveraging Ethereum’s smart contract capabilities for business applications.

Potential Risks for Ethereum

- Scalability and Gas Fees: Despite improvements, Ethereum still faces competition from cheaper and faster Layer-1 and Layer-2 solutions.

- Regulatory Scrutiny: Governments may impose stricter regulations on smart contracts and DeFi platforms.

- Rising Competitors: Solana, Avalanche, and other next-gen blockchains are gaining traction with faster transactions and lower fees.

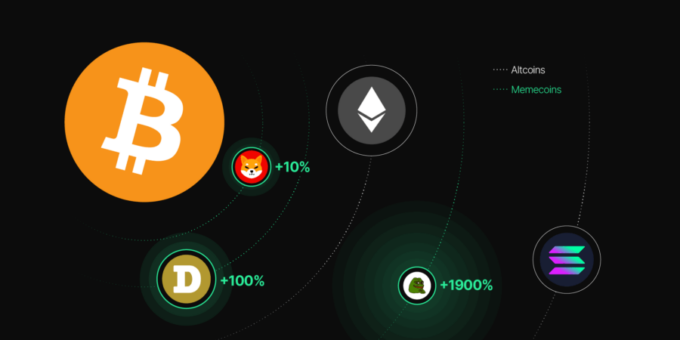

Emerging Altcoins and New Market Trends

Top Altcoins to Watch in 2025

While Bitcoin and Ethereum continue to lead, several altcoins are making significant advancements and could challenge their dominance:

- Solana (SOL): Known for its ultra-fast transactions and low fees, Solana is a strong contender in the smart contract space.

- Cardano (ADA): With ongoing network upgrades, Cardano is enhancing its DeFi and smart contract capabilities.

- Polkadot (DOT): A leader in blockchain interoperability, allowing different networks to connect and communicate efficiently.

- Chainlink (LINK): A critical player in providing real-world data to smart contracts.

- Cosmos (ATOM): Pioneering the vision of a fully interoperable blockchain ecosystem.

The Rise of Web3 and Decentralization

The concept of Web3, powered by blockchain technology, is gaining momentum. Decentralized applications (DApps), metaverse projects, and decentralized autonomous organizations (DAOs) are creating new investment opportunities and shifting the digital landscape.

Regulatory Landscape and Its Impact

Global Regulations in 2025

As the crypto market matures, governments worldwide are introducing regulations to ensure investor protection and prevent illicit activities.

- United States: The SEC is refining its stance on cryptocurrencies, potentially classifying certain assets as securities.

- European Union: The Markets in Crypto-Assets (MiCA) framework is setting standardized regulations across Europe.

- Asia: Countries like Japan and South Korea are embracing regulatory clarity, while China continues to ban crypto trading.

Investment Strategies for 2025

How to Invest in Crypto in 2025

Given the dynamic nature of the market, here are some key strategies to maximize returns:

- Diversification: Invest in a mix of Bitcoin, Ethereum, and promising altcoins to reduce risk.

- Staking and Yield Farming: Earn passive income by staking cryptocurrencies or participating in DeFi protocols.

- Long-Term Holding (HODLing): Historically, long-term investors have seen significant gains despite market volatility.

- NFTs and Metaverse Projects: Consider exposure to digital assets beyond cryptocurrencies, including virtual real estate and blockchain-based gaming.

Final Thoughts: Will Bitcoin and Ethereum Maintain Their Lead?

Bitcoin and Ethereum have established themselves as the dominant forces in the cryptocurrency space, but competition is heating up. While they are likely to remain at the top, the rise of new altcoins, DeFi projects, and Web3 innovations could shift market dynamics. Investors should stay informed, diversify their portfolios, and adapt to the evolving crypto landscape in 2025.