The word “budget” can make a lot of people cringe. It brings to mind restrictive spreadsheets, complicated tracking, and giving up everything you enjoy. It is no wonder that so many people try to create a budget, only to abandon it a few weeks later in frustration.

But what if a budget was not a financial straitjacket? What if it was a tool for empowerment?

A good budget is not about restriction; it is about intention. It is a plan that gives you permission to spend while ensuring you are still moving toward your biggest financial goals. It is the single most powerful tool for taking control of your money and reducing financial anxiety. This guide will walk you through a simple, step-by–step process to create a monthly budget that you can actually stick to.

Step 1: Understand Where Your Money is Going

You cannot make a plan for your money’s future until you know its past. The first and most crucial step is to track your spending. You need a clear, honest picture of where every dollar is going.

-

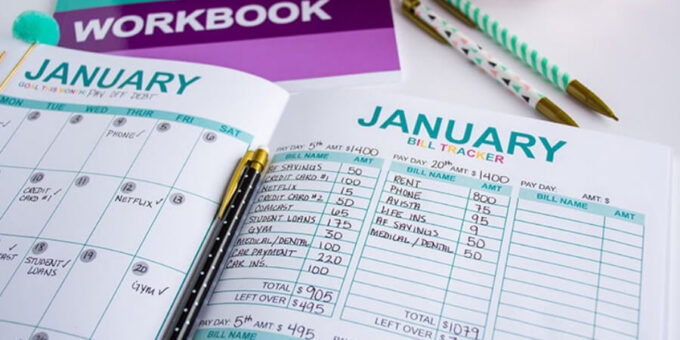

How to Do It: For one month, track every single expense. You can do this with a simple notebook, a spreadsheet, or by using a budgeting app that automatically syncs with your bank accounts.

-

Be Brutally Honest: This is a no-judgment zone. The goal is not to feel guilty about your morning coffee; the goal is to gather data. You need to know exactly how much you are spending on groceries, gas, subscriptions, dining out, and entertainment.

This step is often the most eye-opening part of the entire process.

Step 2: Choose Your Budgeting Method

There is no one-size-fits-all budget. The best method is the one that feels intuitive to you. Here are three of the most popular and effective approaches.

The 50/30/20 Rule (The Simple and Flexible Method)

This is a fantastic starting point for beginners because of its simplicity. You divide your after-tax income into three main categories.

-

50% for Needs: This category covers your essential, must-have expenses. This includes housing (rent/mortgage), utilities, groceries, transportation, and insurance.

-

30% for Wants: This is everything else that makes life enjoyable but is not strictly necessary. This includes dining out, shopping, hobbies, travel, and streaming services.

-

20% for Savings and Debt Repayment: This portion is for your future self. It goes toward paying off debt (beyond minimum payments), saving for retirement, and building your emergency fund.

The Zero-Based Budget (The Detailed Method)

This method is for people who like to have a plan for every single dollar.

-

How it Works: You start with your monthly income and subtract all of your expenses until the total equals zero. This means every dollar has a specific job, whether it is for rent, savings, or your “fun money” category. It forces you to be highly intentional with your spending.

The “Pay Yourself First” Method (The Automated Method)

This is the simplest method of all and focuses on your savings goals above all else.

-

How it Works: The very first thing you do when you get paid is to automatically transfer a set amount of money into your savings and investment accounts. You then have the freedom to spend the rest of what is left in your checking account, knowing that your most important goals have already been taken care of. For this to be most effective, your savings should be in a separate, high-yield account.

Step 3: Set Your Financial Goals

A budget without a goal is just a list of numbers. Your “why” is what will keep you motivated. What do you want your money to achieve for you?

-

Short-Term Goals (1-3 years): Building an emergency fund, saving for a vacation, paying off a credit card.

-

Mid-Term Goals (3-10 years): Saving for a down payment on a house, buying a new car.

-

Long-Term Goals (10+ years): Saving for retirement, saving for a child’s education.

Assign a specific dollar amount to each of your top goals. This turns a vague wish into a concrete target.

Step 4: Build Your Budget and Put it into Action

Now it is time to put it all together.

-

List Your Income: Write down your total take-home pay for the month.

-

List Your Expenses: Using the data you tracked, list all your fixed expenses (like rent) and your variable expenses (like groceries).

-

Align with Your Method: Allocate your income according to the method you chose (e.g., 50/30/20).

-

Make Adjustments: Your first draft will not be perfect. You might see that your “Wants” are taking up 45% of your income. This is where you make conscious choices. Can you reduce your dining out budget? Can you cancel a few subscriptions? The goal is to align your spending with your priorities.

Step 5: Review and Adjust Regularly

Your budget is a living document, not a stone tablet. Life changes, and so will your budget. Set aside 30 minutes at the end of each month to review your spending.

Did you overspend in one category? Did you have an unexpected expense? That is okay. The goal is not perfection; it is progress. A monthly check-in allows you to make small adjustments and stay on track.

Conclusion: From Restriction to Freedom

Creating a monthly budget that actually works is one of the most empowering things you can do for your financial well-being. It is the process of telling your money where to go, instead of wondering where it went.

By understanding your habits, choosing a simple method, and staying consistent, you can transform your budget from a source of stress into your personal roadmap to financial freedom. For more official tools and resources on budgeting, the Consumer Financial Protection Bureau (CFPB) offers excellent, unbiased guidance.

You can also read Here about more article.