Understanding the 50/30/20 Rule

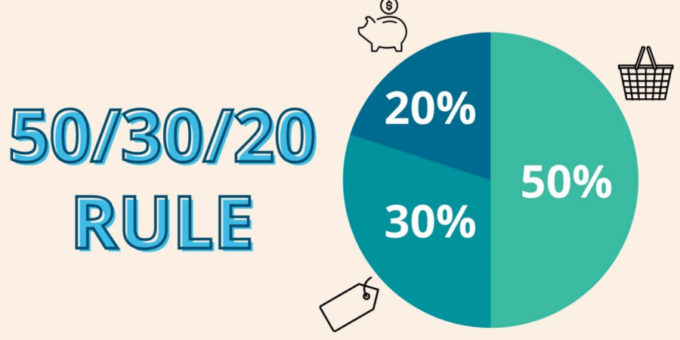

The 50/30/20 rule has been a go-to budgeting framework for many years. Originally popularized by Senator Elizabeth Warren, this method suggests allocating income as follows:

- 50% to Needs – Essential expenses such as rent/mortgage, utilities, groceries, healthcare, and insurance.

- 30% to Wants – Discretionary spending like entertainment, travel, dining out, and hobbies.

- 20% to Savings and Debt Repayment – Contributions to savings accounts, investments, retirement funds, and debt payments beyond minimums.

This simple yet effective strategy has helped millions gain control over their finances. But in 2025, with rising inflation, increased living costs, and evolving financial tools, is the 50/30/20 rule still relevant?

How Inflation and Economic Changes in 2025 Affect Budgeting

Higher Living Costs

With inflation continuing to impact global economies, the cost of essentials such as housing, food, and healthcare has surged. Many individuals find that allocating only 50% of their income to necessities is unrealistic. Rent prices in major cities have skyrocketed, making it difficult to stick to traditional budgeting frameworks.

Increase in Variable Income Streams

The gig economy, freelancing, and side hustles have become more mainstream in 2025. Unlike traditional salaried employees, many workers now experience fluctuating monthly income, making a fixed budget ratio like 50/30/20 harder to follow.

Higher Debt Burdens

With rising student loan debt, credit card interest rates, and increased mortgage payments, debt repayment has become a larger concern for many. The 20% allocation for savings and debt repayment may not be sufficient for individuals facing high financial obligations.

Is the 50/30/20 Rule Still Effective in 2025?

The effectiveness of the 50/30/20 rule depends on individual circumstances. While it provides a good starting point, a few modifications may be necessary to adapt to modern financial realities.

Alternative Budgeting Methods for 2025

1. 60/20/20 Rule – Prioritizing Essentials

With higher living expenses, some individuals have shifted to allocating 60% of their income to needs, while reducing discretionary spending to 20% and keeping savings at 20%.

2. 40/30/30 Rule – Emphasizing Savings

For those focused on early retirement and wealth-building, the 40/30/30 method dedicates 40% to needs, 30% to wants, and 30% to savings and investments.

3. Flexible Budgeting – Adjusting Based on Income Fluctuations

For freelancers and gig workers, a fixed percentage system may not work. Instead, a flexible budgeting approach where expenses and savings are adjusted based on monthly earnings can be more effective.

How to Adapt the 50/30/20 Rule to Fit Your Needs

If you still want to use the 50/30/20 rule as a guideline, here’s how you can tailor it to work for your personal finances in 2025:

1. Reassess Your Fixed Expenses

- Identify unnecessary costs in your “needs” category, such as unused subscriptions or expensive insurance plans.

- Consider relocating to areas with lower living costs if rent takes up too much of your income.

2. Automate Savings & Investments

- Use high-yield savings accounts and automated investment platforms to ensure you’re consistently saving.

- If debt repayment is a major priority, increase contributions to eliminate high-interest obligations faster.

3. Adjust Discretionary Spending

- With a shift towards digital entertainment and work-from-home trends, some “wants” spending may need reevaluation.

- Focus on experiences that provide long-term value rather than short-lived luxuries.

Conclusion: Should You Follow the 50/30/20 Rule in 2025?

While the 50/30/20 rule remains a solid financial guideline, it may not be the best fit for everyone in 2025. Given economic fluctuations, changing income structures, and increased debt burdens, individuals should consider customizing their budgeting approach.

The key takeaway? Use the 50/30/20 rule as a foundation but remain flexible in adapting it to your financial situation. Whether you shift to a 60/20/20 model, adopt a savings-heavy approach, or create a hybrid method, the most important goal is to maintain control over your finances and work toward long-term financial stability.

Final Thoughts

Are you still following the 50/30/20 rule, or have you adjusted your budgeting strategy for 2025? Let us know in the comments and share your best money-saving tips!